Georgia Travel Insurance 2026: Requirements, Coverage & Tips

I’ve always recommended getting travel insurance for Georgia, even back when it wasn’t strictly required. Things changed in January 2026, and from now on, Georgia travel insurance is no longer just an advice — it’s a legal entry requirement for most foreign visitors, including those who can enter visa-free.

If you’re planning a trip in 2026 or later, you’re now expected to arrive with valid travel health insurance for Georgia that meets the official requirements.

This update has caused a fair amount of confusion, especially among repeat visitors, digital nomads, and long-term travelers who’ve been coming here for years without ever being asked for a policy.

I see this come up often in broader Georgia travel planning discussions, where questions like “Is travel insurance required for Georgia?”, “How to get it?” and “What are the requirements?” are common in travel and expat groups.

In this guide, I break down what the new law actually requires, how mandatory travel insurance is being checked so far, and which travel medical insurance plan is most likely to be accepted without issues, no matter if you’re visiting for a short trip, staying longer, or planning to base yourself in Tbilisi or elsewhere in Georgia.

Please note: This article is for general informational purposes only and reflects my own research, official public information available at the time of writing, and real-time experiences shared by travelers in travel and expat communities. It is not legal advice. Entry requirements, insurance checks, and enforcement practices in Georgia may vary by airline, border point, and individual circumstances, and can change without notice. Travelers are always responsible for confirming current requirements with their airline, insurance provider, or relevant Georgian authorities before traveling.

Disclaimer: Some of the links in this post are affiliate links, which means I may earn a small commission if you buy something through them—at no extra cost to you. It helps support my blog and lets me share real, first-hand travel tips. Learn more

Quick essentials: Georgia travel insurance requirements 2026

If you’re traveling to Georgia in 2026 or later, this is what you need to know in short.

- Required from January 2026: Mandatory travel insurance applies to most foreign visitors entering Georgia from this date onward. The rule is not applied to travelers who entered before January 2026.

- Who needs it: Most foreign nationals entering Georgia as tourists, including visa-free travelers.

- What kind of insurance: Your insurance policy must include travel medical insurance covering both medical treatment and accident-related expenses.

- Minimum coverage: At least 30,000 GEL (~ 11,154 USD | 9,540 EUR) for medical treatment and hospitalization.

- Validity: Your insurance must be valid for your entire stay, including your arrival and departure dates.

- Who can issue the policy: Insurance can be issued by a foreign or Georgian insurance provider, provided it meets the requirements.

- Proof of insurance: You should be able to present a policy document in English or Georgian, either digitally or printed. Airlines may ask for proof before boarding, and checks can also happen on arrival.

- If you don’t have insurance: You may be denied boarding, refused entry, or fined (reported at 300 GEL)

- Exemptions: Certain categories are exempt, including holders of Georgian residency, diplomatic or official passports, and individuals covered by specific international agreements.

Who needs travel insurance to enter Georgia (and who is exempt)

Under the current rules, travel health insurance for Georgia is required for most foreign nationals entering the country as tourists, whether they arrive visa-free or on a tourist visa, and are not Georgian residents and do not hold a residence permit.

In simple terms, if you are entering the country on a foreign passport and do not hold a status that explicitly exempts you, you should assume that travel insurance is mandatory for your entry.

According to Georgia’s Law “On Tourism,” a tourist is defined as a foreign national who stays in Georgia for at least one night and remains in the country for no longer than one year.

Based on the current interpretation, travelers arriving on a working visa are generally treated differently, and employer-provided health insurance that begins on the date of arrival is typically considered sufficient for entry purposes. In these cases, the policy does not necessarily need to meet the standard coverage threshold. However, I still advise you to double-check with your employer if you fall into that category.

This mandatory travel insurance rule also applies to travelers coming from the US, Europe, the Gulf, India, and other regions — the requirement is not nationality-specific.

Who is exempt from the requirement

The following categories are exempt from mandatory travel insurance for Georgia under the current regulation:

- Holders of Georgian residence permits and Georgian citizens (reported by individuals, but not included on official documents thus far)

- Holders of diplomatic or special visas

- Holders of diplomatic, official, service, or special passports

- Representatives of diplomatic missions, embassies, and consular offices, along with their immediate family members

- Persons whose entry into Georgia is provided for by international agreements or treaties of Georgia

- Drivers engaged in international road freight or passenger transportation

If you fall into one of these categories, insurance may not be required for entry, but you should still confirm your specific situation in advance.

Plan Your Trip to Georgia Like A Pro

A note for repeat and long-term visitors

One of the most common misunderstandings comes from travelers who have visited Georgia many times before. Past experience is no longer a reliable guide. Even if you’ve entered Georgia without insurance before, you may now be asked to show proof of it at check-in, the gate, or on arrival.

Long-term stays, residence permits, and local health insurance raise additional questions, which I cover in detail later in this guide.

What your Georgia travel insurance must cover

Under the current Decree No. 602, the insurance policy must include both medical treatment and accident-related coverage. In practice, this means your insurance should function as travel health insurance, covering everything from emergency consultations and hospital treatment to accidents that may occur during your stay.

The regulation also sets a clear minimum coverage amount. Your travel insurance for Georgia must provide at least 30,000 GEL in medical coverage. While everyday healthcare in Georgia is relatively affordable, this requirement is mainly aimed at serious situations such as hospitalisation, surgery, or emergency care — costs that can escalate quickly without insurance.

It must be valid for the entire duration of your stay, including your arrival and departure dates. Policies covering only part of your trip or that expire mid-stay may not be considered compliant.

Your insurance can be issued by either a Georgian or foreign insurance provider; the document must be available in English or Georgian and can be presented digitally or in printed form upon request.

According to the decree, a compliant insurance policy document should clearly specify:

- insured parties

- covered territory

- insurance subject

- coverage start and end dates

- insured risks

- coverage limit amount

- payment terms

How insurance checks happen in practice (airlines, borders, real reports)

While the insurance is now part of Georgia’s official entry rules, how checks are carried out can still vary depending on how and where you enter the country. Based on recent traveler reports, the most consistent checks occur before departure rather than at the border.

Airline checks before boarding

For travelers arriving by air, airlines are currently the main gatekeepers. Because carriers are responsible for ensuring passengers meet entry requirements, many now require proof of insurance coverage at check-in and/or at the boarding gate. This is especially common on international routes where airlines already verify visas and other documents.

In practice, airline staff usually look for a clear insurance policy document showing: coverage dates, medical coverage amount, and destination (Georgia).

There have also been reports of airlines questioning policies that list coverage as “100%” rather than specifying a monetary amount. Even if coverage is technically sufficient, documents without a clear amount may cause delays or confusion at check-in.

Travelers without acceptable proof have reported being denied boarding, even when they planned to arrange insurance online later. This is why relying on last-minute solutions can be risky.

Border checks on arrival

Reports from passport control on arrival in Georgia are mixed. Some travelers say they were not asked about it at all, while others report brief questions or document checks. This inconsistency simply reflects that enforcement is still settling.

It’s also worth noting that border officers have the legal right to request proof of medical insurance, even if checks are not applied uniformly to every traveler.

Land borders and regional travel

Travelers entering Georgia by land — for example, from Armenia or Turkey (the Azerbaijan-Georgia land border remains closed) — report fewer checks so far. Some travelers report not being asked for insurance. However, the legal obligation remains the same regardless of the entry point.

What happens if you don’t have travel insurance

Arriving without travel insurance can lead to consequences, even if enforcement still varies. While not every traveler is checked, the responsibility to meet entry requirements ultimately lies with you.

The most common issue reported so far is being stopped before departure. Airlines may refuse boarding if you cannot show an acceptable document that meets Georgia’s entry rules. This applies even if you planned to arrange travel insurance online after landing, or assumed your existing coverage would be sufficient.

In cases where travelers do reach Georgia without insurance, border authorities have the right to take action. This can include being refused entry or being issued a fine. While there is no officially published penalty schedule yet, some reports mention fines being imposed for non-compliance.

It’s also important to note that lacking insurance doesn’t just affect entry. Without proper insurance, you would be fully responsible for any medical expenses, emergency treatment, or hospitalization if needed during your stay. While everyday healthcare in Georgia can be affordable, unexpected situations and accidents do happen, and they quickly become costly.

There is also a possibility that insurance validity may be checked upon exit, as the policy is required to cover the entire stay from entry to departure. At the time of writing, the system of fines and sanctions has not been officially clarified.

How to get travel insurance for Georgia

Getting Georgia travel insurance online is usually straightforward, and for most travelers, it can be arranged in a matter of minutes before departure. The key is choosing a policy that clearly meets the entry rules, is easy to verify, and suits your budget.

For short trips, many travelers opt for international travel insurance for Georgia purchased from global providers that offer ready-made travel insurance plans. These policies are designed specifically for international travel and typically include medical, emergency treatment, and medical evacuation coverage, with limits that comfortably exceed the minimum requirements.

Annual or multi-trip insurance policies are also acceptable, as long as coverage is active at the time of entry and valid for the period you are staying in Georgia.

Cost is another common concern. While many people search for the cheapest travel insurance for Georgia, price should never come at the expense of clear medical coverage. A slightly higher premium is often worth it if it means your policy is accepted without question at check-in or on arrival.

The safest approach is to choose a well-documented insurance provider, such as those listed below, and purchase your policy before traveling.

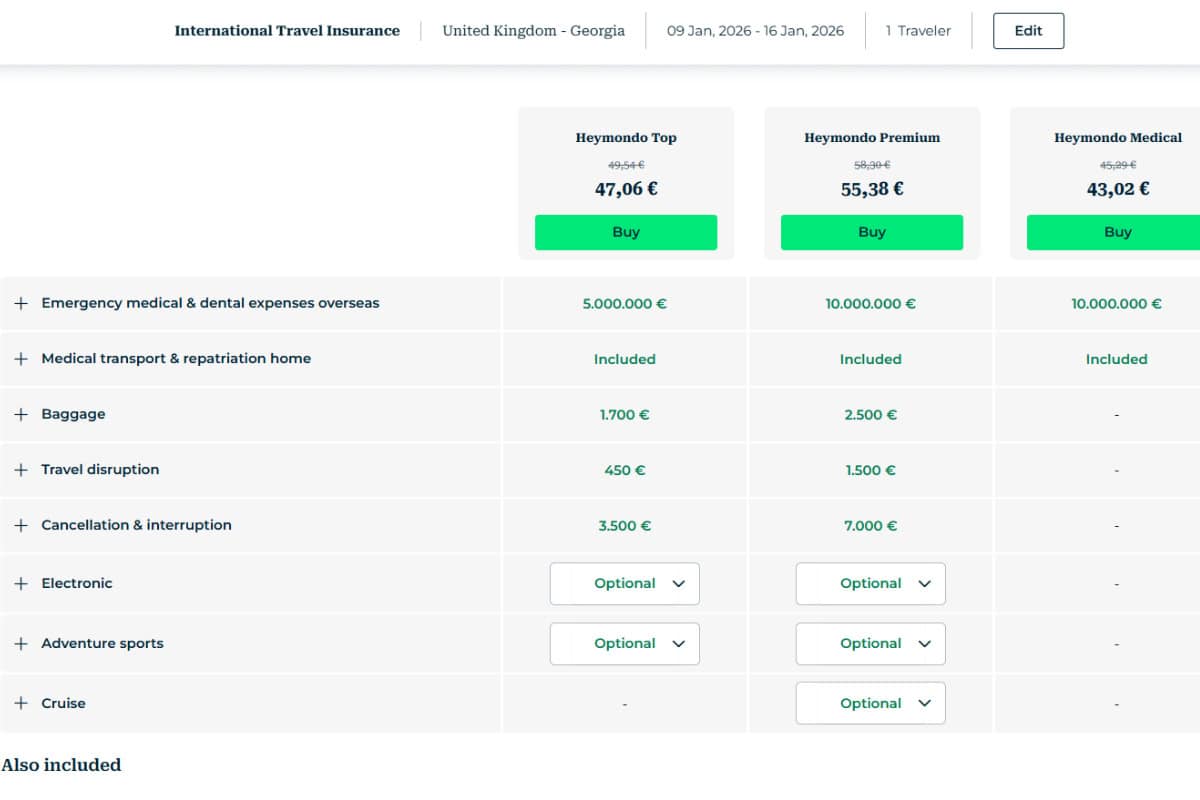

HeyMondo — a solid all-round option

For most short-term travelers, HeyMondo is one of the easiest and most reliable choices, and is often considered among the best travel insurance for Georgia. Their policies are designed specifically for international travel and include medical treatment, hospitalisation, accident cover, and emergency assistance, with coverage limits that comfortably meet Georgia’s entry requirements.

HeyMondo policies are issued instantly in English, clearly list Georgia as a covered destination, and display coverage dates and limits in a format airline and airport staff can easily verify. This makes them a low-friction option if you want something straightforward that won’t raise questions at check-in.

👉 Check out HeyMondo’s policy and automatically get 5% off on your travel insurance plans

SafetyWing — popular with long stays and flexible travel

If you’re planning a longer stay or traveling without a fixed return date, SafetyWing is often a better fit. Their insurance is subscription-based and widely used by digital nomads and long-term travelers. Coverage includes emergency medical treatment, hospitalisation, accident cover, and medical evacuation, and it renews automatically as long as your subscription remains active.

For entry to Georgia, you should be able to show that your coverage is active at the time of entry and valid for your ongoing stay. While this usually isn’t an issue, it’s worth downloading a clear policy document or confirmation that shows active coverage rather than relying on a dashboard screenshot alone.

👉 Check out SafetyWing plans and decide which one suits you best

Georgian insurance providers — budget-friendly local options

Some travelers prefer to use local providers, especially for shorter stays or budget travel. A few Georgian companies currently offer insurance products suitable for foreigners visiting the country, and these are often the cheapest travel insurance for Georgia.

TBC Insurance offers travel insurance designed for visitors, with prices starting at around 1.5 EUR per day (~5 GEL | 1.75 EUR), depending on coverage and duration. Policies can be purchased online, are clearly worded, and are generally accepted for entry purposes.

Imedi L is another local provider that currently offers insurance for foreign visitors, with basic policies starting from around 2 GEL per day (~0.74 USD | 0.64 EUR).

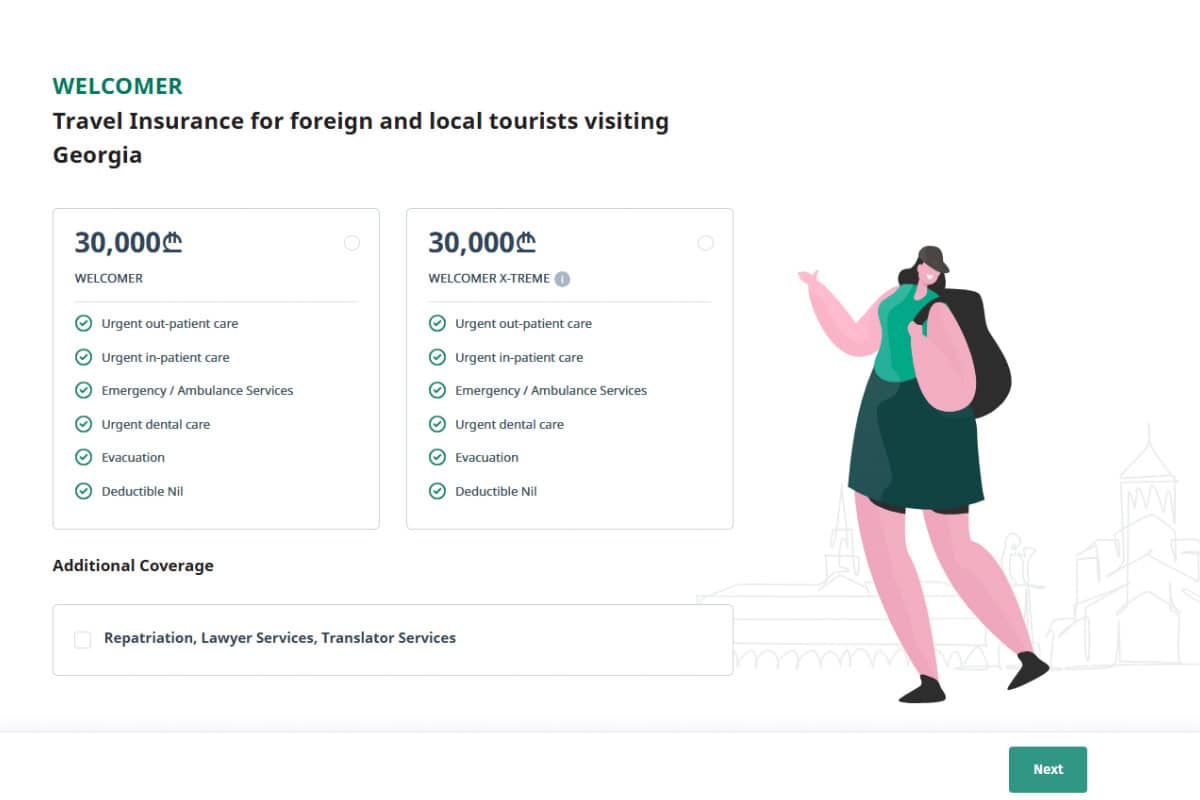

Another option is ARDI’s “Welcomer” visitor insurance package, designed specifically for foreigners and available for purchase online.

Many other Georgian insurance companies, such as GPI or IRAO, still focus primarily on outbound travel insurance for Georgian nationals at the time of writing, so not every local policy will be suitable for entry. If you choose a Georgian provider, it’s important to double-check that the policy is intended for foreigners visiting Georgia, not for Georgian citizens traveling abroad.

Age limits are another practical consideration. Some Georgian insurers do not offer coverage to travelers over 60 or 65. In such cases, international providers or companies like UNISON, which offer insurance for older travelers, may be a more realistic option.

Best Tbilisi Tours & Day Trips – Handpicked by Local

Insurance you already have: when it works — and when it doesn’t

I see a lot of questions from travelers asked in expat and tourist groups about whether their existing insurance will be enough. If you already have an annual or multi-trip insurance policy, it may be acceptable for entry, as long as it’s active when you arrive and covers the period you’ll be staying in Georgia.

Credit card travel insurance

While some cards advertise travel benefits, the actual insurance coverage is often limited, conditional, or difficult to prove.

Airline staff and border officials usually need a formal policy document, so I’d suggest downloading one that clearly shows coverage, limits, and territory. Your card insurance may not be accepted — even if it technically exists.

Employer or private health insurance

Another common assumption is that private health insurance at home will cover international travel. While some plans do include overseas treatment, many do not function as travel medical insurance, and some only reimburse costs after the fact. Therefore, check with your provider beforehand.

Can you buy travel insurance on arrival in Georgia?

At the moment, there is no official system for purchasing it on arrival in Georgia at airports or land borders. Because travel insurance is mandatory, airlines may refuse boarding if you can’t show an active policy before departure. And even if they do, the border officer might not let you in.

In theory, you could purchase insurance immediately after entering the country, but in practice, this only works if you are allowed to travel in the first place. For this reason, relying on arrival-based solutions is risky and not recommended under the current rules.

Best Hotels in Tbilisi – Where to Stay

Not sure which area suits you best? 📍 Check out my Where to Stay in Tbilisi guide for the top neighborhoods and hotel picks by budget before booking. Here are my quick picks for the best places to stay right now.

Long-term stays, re-entry, and local health insurance

This is where things become less clear — especially for people who stay in Georgia for extended periods or return frequently.

Many long-term visitors and expats rely on local health insurance once they are already in the country- especially those who’ve chosen to base themselves in Tbilisi rather than just passing through. While this can work well for everyday medical treatment in Georgia, it does not always meet entry requirements.

Local health insurance policies often don’t specify coverage limits in a way that satisfies entry checks, and some can only be purchased after arrival.

If you leave Georgia and re-enter, for example, when doing so-called “visa runs” to restart your 365-day stay, you may still be asked to show valid travel medical insurance upon re-entry unless you hold Georgian citizenship or a residence permit.

That said, there is no clear wording in Decree No. 602 for residence permit holders yet. If you’re in this category, it’s safest to confirm requirements directly before traveling, rather than assuming exemption.

Based on early interpretations, the mandatory insurance requirement does not apply to foreign nationals entering Georgia on a working visa. If your Georgian employer provides health insurance starting from your arrival date, this is generally considered sufficient for entry purposes, even if the coverage limit is below 30,000 GEL. However, I would suggest double-checking with them before departure to avoid issues.

Healthcare, medical costs, and real risks in Georgia

Georgia is generally a safe destination, and most trips pass without any serious issues. That said, understanding the real risks travelers are more likely to face helps explain why adequate insurance coverage matters.

In major cities such as Tbilisi, Kutaisi, and Batumi, private healthcare is widely available and relatively affordable. Routine medical treatment, consultations, and basic diagnostics usually cost far less than in Western Europe or North America.

For minor issues, many travelers pay out of pocket without problems. However, more serious situations — including hospitalisation, surgery, or specialist care — can quickly increase expenses.

One of the most common risks for visitors in Georgia is road safety. Traffic accidents are not uncommon, and driving standards can feel unpredictable for first-time visitors. This applies whether you’re self-driving, taking long-distance taxis, riding in marshrutka minibuses, or traveling on mountain roads.

Accidents involving tourists do happen every year, and this is where emergency medical cover and, in some cases, medical evacuation become important.

Outdoor activities also come with risks. Hiking in the Caucasus, winter sports, and exploring remote regions, such as Tusheti, Racha, or Svaneti, can mean limited access to medical facilities and longer response times in the event of an injury. Even a relatively minor accident can turn complicated if evacuation or specialist treatment is needed.

When it comes to crime, petty crime in Georgia is relatively rare compared to many European cities. Pickpocketing does happen occasionally in crowded areas, public transport, or tourist-heavy spots, but violent crime against visitors is uncommon.

Most travelers won’t need extensive theft coverage, though it’s still worth checking whether your insurance policy includes valuables coverage if you’re traveling with cameras or other expensive equipment.

This is the clearest and most comprehensive overview I have read on this matter. Thank you.